A Title Loan for back to school expenses offers quick cash using your vehicle's title as collateral, with approval often same-day. While convenient and flexible, these loans carry high interest rates, potential repossession risks, and strict requirements like clear vehicle titles. Before considering one, explore student aid, scholarships, or part-time jobs as alternatives to manage educational costs effectively and avoid financial burdens associated with title loans.

“As the new academic year approaches, many students and families seek financial solutions to cover unexpected back-to-school expenses. One option gaining traction is the title loan—a quick fix for immediate cash needs. This article explores both sides of this controversial method, providing insights into what a title loan is and how it functions. We weigh the pros, such as fast approval and flexible terms, against potential cons like high-interest rates and the risk of default. Understanding these factors can help parents make informed decisions regarding their educational funding.”

- What is a Title Loan and How Does it Work?

- Pros of Using a Title Loan for Back to School Expenses

- Cons of Taking out a Title Loan for Educational Costs

What is a Title Loan and How Does it Work?

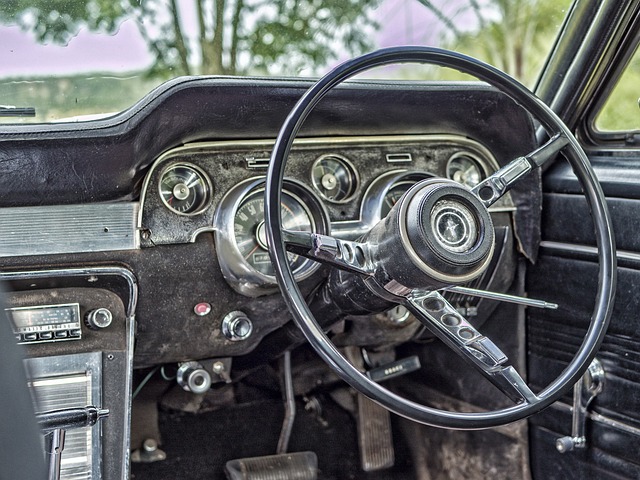

A Title Loan for back to school expenses is a short-term borrowing option secured by an individual’s vehicle—typically a car or motorcycle (in some cases, even boats or RVs). It offers a quick and easy way to access cash during times of financial need. The process works as follows: the borrower provides the lender with their vehicle’s title as collateral and agrees to repay the loan within a specified period, usually 30 days to a few months. Upon successful repayment, the borrower receives their title back. This type of loan is particularly appealing for students facing unexpected costs, such as tuition fees, textbooks, or other educational expenses.

While convenient, it’s crucial to understand that these loans carry significant risks. If the borrower fails to repay, they could lose their vehicle. Additionally, interest rates tend to be higher compared to traditional loans, and there might be hidden fees associated with the transaction, including loan extensions if the borrower cannot pay off the balance on time. It’s essential to consider alternatives like student aid, scholarships, or part-time jobs before opting for a Title Loan for back to school expenses, especially when evaluating options for managing educational costs effectively and avoiding potential financial burdens.

Pros of Using a Title Loan for Back to School Expenses

Using a Title Loan for back to school expenses can offer several advantages. One of the key benefits is the speed and convenience it provides. Unlike traditional loans that require extensive paperwork and a lengthy approval process, a title loan can be approved much faster, often within the same day. This is particularly useful during the hectic back-to-school season when immediate financial support is needed to cover various expenses, from buying textbooks and supplies to funding transportation and other necessities.

Another advantage is the flexibility it offers in terms of repayment. Unlike credit cards with high-interest rates and strict repayment deadlines, a title loan typically has more lenient terms and allows for a longer repayment period. Additionally, with Fort Worth Loans, borrowers can explore options for a loan extension if needed, providing further financial breathing room. This flexibility ensures that students and their families can focus on academic pursuits without the added stress of managing tight financial deadlines.

Cons of Taking out a Title Loan for Educational Costs

While a Title loan for back to school expenses might seem like a quick solution, there are several potential drawbacks to consider. One significant con is the high-interest rates often associated with such loans. These rates can quickly compound, leading to a debt cycle where the initial educational cost is significantly inflated. This not only makes repayment more challenging but also increases the overall financial burden on students and their families.

Additionally, the process of securing a Title loan for back to school expenses usually involves strict loan requirements, including a clear vehicle title as collateral. This can be problematic for students who might have limited credit history or income, making it difficult to meet these criteria. Moreover, missing payments can result in severe consequences, such as repossession of the collateral vehicle, which could disrupt academic pursuits and overall financial stability.

When considering a title loan for back-to-school expenses, it’s crucial to weigh both the advantages and disadvantages. While this short-term solution can provide quick cash for urgent needs, it comes with significant drawbacks such as high-interest rates and the risk of default impacting your vehicle. Before deciding, explore alternative funding options like scholarships, financial aid, or student loans to ensure you make an informed choice that best supports your educational journey without long-term financial burden.