Students with financial challenges can opt for title loans as a quick fix for back-to-school expenses, but they carry risks. These loans, secured against vehicle titles, offer fast cash with flexible terms, yet borrowers risk losing their collateral if they default. Exploring traditional aid and choosing reputable lenders is crucial for responsible borrowing to avoid long-term financial strain.

Back to school season often brings unexpected costs. If you’re a student facing financial strain, a title loan could be an option, but it’s crucial to understand this short-term solution’s implications. This guide explores what title loans are and how to use them responsibly for educational expenses. Weigh the benefits and risks, learn effective borrowing strategies, and make informed decisions to navigate back to school funding smoothly.

- Understanding Title Loans for Students

- Benefits and Risks: Weighing Your Options

- Responsible Borrowing Strategies for Back to School

Understanding Title Loans for Students

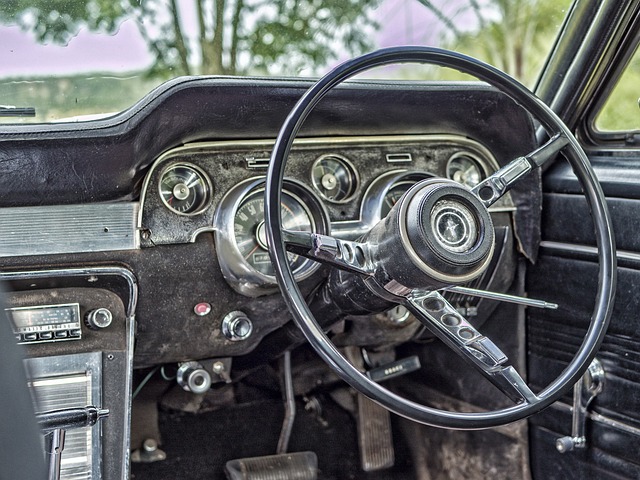

Students often face financial challenges when preparing for the new academic year, and this is where a title loan for back to school expenses can be a helpful option. These loans are designed to provide quick access to cash based on the value of an individual’s asset, typically their vehicle or motorcycle. In simple terms, it allows students to borrow money by using their vehicle title as collateral. This alternative financing method is particularly appealing for those who may not have established credit or need immediate funds.

A cash advance through a Fort Worth loans provider offers several benefits for students. It provides a short-term solution to cover unexpected costs, such as textbooks, school supplies, or even transportation expenses. Unlike traditional bank loans, these loans often have less stringent eligibility criteria and faster approval times, making them attractive during the back-to-school season. However, it’s crucial to approach this option responsibly, ensuring that the loan terms are understood and that repayment capabilities are within reach to avoid potential financial strain.

Benefits and Risks: Weighing Your Options

A Title loan for back to school expenses can be a quick solution for students facing financial constraints during their academic journey. One of its key benefits is accessibility; it provides a short-term funding option with relatively simple eligibility requirements, often just needing a valid driver’s license and vehicle registration. This can be particularly useful when unexpected costs arise, such as textbook purchases or transportation needs. Additionally, these loans offer flexibility in terms of flexible payments, allowing borrowers to manage their repayments according to their financial comfort levels.

However, it’s crucial to consider the potential risks associated with this option. Taking out a title loan means using your vehicle as collateral, which could result in serious consequences if you’re unable to repay. The lender has the right to repossess your vehicle if payments are missed or defaulted upon. Moreover, these loans often come with higher-than-average interest rates and fees, making them costlier in the long run. A thorough understanding of the vehicle inspection process and the potential impact on your vehicle’s value is essential before pledging it as collateral.

Responsible Borrowing Strategies for Back to School

When considering a title loan for back to school expenses, it’s crucial to adopt responsible borrowing strategies. Students and parents should first explore traditional financial options like student loans, grants, and scholarships. These avenues often offer lower interest rates and more flexible repayment terms. If a title loan becomes necessary, lenders should be carefully chosen, with emphasis on reputable institutions that provide transparent terms and conditions.

Additionally, understanding the borrowing process is essential. A quick approval process can be enticing, but it’s vital to remember that a vehicle inspection is typically required. This step ensures the security of the loan and serves as a protection for lenders. Same-day funding might seem appealing, but it could lead to hasty decisions. Borrowing only what is necessary and creating a realistic repayment plan will help avoid financial strain later. Responsible borrowing means balancing immediate needs with long-term financial health.

When considering a title loan for back to school expenses, it’s crucial to balance immediate financial needs with long-term stability. By understanding the benefits and risks of these loans and employing responsible borrowing strategies, students can make informed decisions that support their academic pursuits without falling into debt traps. Remember, wise financial management is key to navigating this option successfully.