Students facing unexpected financial hurdles during back-to-school season can turn to a title loan for back to school expenses as a quick funding solution using their vehicle's title as collateral, offering lower interest rates than traditional banking options, and flexible repayment terms while keeping vehicle ownership.

Back to school is a bustling time, but managing costs can be a challenge. If you’re a student facing unexpected expenses, understanding title loans as an option can provide financial relief. This article explores how these short-term, high-value loans work specifically for educational needs. We delve into unlocking low-interest rate options and offer strategies to save on back-to-school costs, ensuring a smoother transition to the new academic year without breaking the bank.

- Understanding Title Loans for Students

- Unlocking Low-Interest Rate Options

- Strategies to Save on Back-to-School Costs

Understanding Title Loans for Students

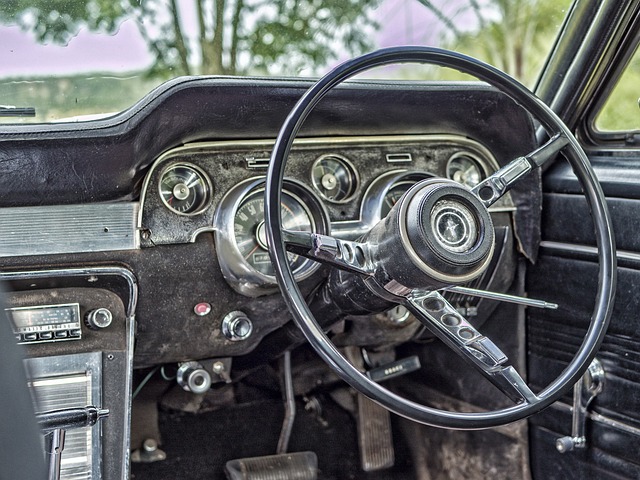

Students often face unexpected financial challenges when getting ready for the new academic year. Back to school expenses can quickly add up, leaving many seeking quick funding solutions. One option gaining popularity is a title loan, specifically tailored to meet the needs of students and offer them a reliable source of financial support. This type of loan uses your vehicle’s title as collateral, allowing you to access funds without strict credit requirements. It’s an attractive option for those in need of fast cash for various educational-related expenses.

Understanding how these loans work is essential when considering a title loan for back to school expenses. The process typically involves providing your vehicle’s registration and proof of insurance. Lenders then assess the value of your car to determine the maximum loan amount available. Unlike traditional loans, with a title loan, you retain ownership of your vehicle during the repayment period. Additionally, there are various repayment options and loan extension possibilities, making it easier for students to manage their finances while focusing on studies.

Unlocking Low-Interest Rate Options

When it comes to managing back-to-school expenses, students and their families often seek flexible financial solutions. Unlocking low-interest rate options for a Title loan can be a strategic move during this time. These loans offer an alternative to traditional banking options, especially for those who need quick access to funds. By using your vehicle as collateral, you can secure a loan with potentially lower interest rates compared to short-term credit alternatives.

This approach allows individuals to keep their vehicle while accessing the needed capital for educational expenses. Unlike fast cash loans that may come with stringent requirements and higher costs, a Title loan provides a more sustainable option. It’s particularly beneficial for students who prefer not to burden themselves with excessive debt early in their academic journey. By leveraging vehicle collateral, borrowers can negotiate better terms, ensuring they receive the best possible deal tailored to their financial needs for back-to-school preparations.

Strategies to Save on Back-to-School Costs

Back-to-school season can be a financially demanding time, but there are several strategies to save on essential expenses. One effective approach is to plan and prepare in advance, creating a budget and prioritizing needs over wants. Start by assessing your current financial situation; this will help you identify areas where you can cut back and allocate more funds towards education-related costs. Consider secondhand options for textbooks, uniforms, and supplies to significantly reduce expenses without compromising quality. Many schools and communities offer used item sales or online platforms dedicated to these resources.

Additionally, exploring alternative funding sources like title loan for back to school expenses can provide a safety net. Options such as motorcycle title loans offer lower interest rates compared to traditional personal loans, especially if you own a vehicle with substantial equity. Keeping your vehicle and using its title as collateral ensures that you retain possession while accessing much-needed funds. This strategic approach allows parents and students to focus on academic pursuits without the added stress of financial strain.

When it comes to managing back-to-school expenses, exploring low-interest title loan options can provide students with a flexible and accessible solution. By understanding the mechanics of title loans and leveraging strategies to save, you can navigate these financial challenges effectively. Remember that while a title loan for back to school expenses may offer relief, responsible borrowing and strategic planning are key to avoiding debt traps. In terms of securing your academic future, every dollar saved could open doors to greater opportunities down the line.