Back-to-school costs can be a challenge, but a title loan for back to school expenses offers a flexible solution. Using your vehicle's equity, these loans provide quick cash for tuition, books, and unexpected costs. With customizable repayment terms, families can manage their budget effectively. Reputable lenders offer online applications, and approved borrowers can discuss budget-friendly payment plans with potentially lower interest rates.

“As students prepare for the new academic year, managing financial obligations can be a significant challenge. Enter flexible term title loans—a swift and innovative solution for covering back-to-school expenses. This article explores how these loans, secured against a vehicle’s title, offer students a breathing space with adjustable terms, making it easier to focus on studies without the immediate burden of heavy debt. We’ll guide you through understanding this option and navigating the process.”

- Understanding Title Loans: A Quick Cash Solution for Students

- How Flexible Terms Can Make Back-to-School Smooth Sailing

- Navigating the Process: Getting a Title Loan for Educational Expenses

Understanding Title Loans: A Quick Cash Solution for Students

For many students, back-to-school expenses can be a significant financial burden, especially if unexpected costs pop up or savings aren’t quite enough to cover everything. This is where understanding flexible terms for a title loan for back to school expenses becomes crucial. A car title loan, in this context, refers to a short-term lending option secured by your vehicle’s registration – meaning you can access quick approval and financial assistance without needing perfect credit.

This type of loan provides a fast and accessible solution when students need cash flow for tuition fees, books, supplies, or other unexpected costs. The process is straightforward, with minimal paperwork required. Once approved, borrowers can use the funds as needed to bridge any gap between their current finances and back-to-school expenses. Remember, while this option offers quick relief, it’s essential to have a plan for repayment to avoid potential financial strain later on.

How Flexible Terms Can Make Back-to-School Smooth Sailing

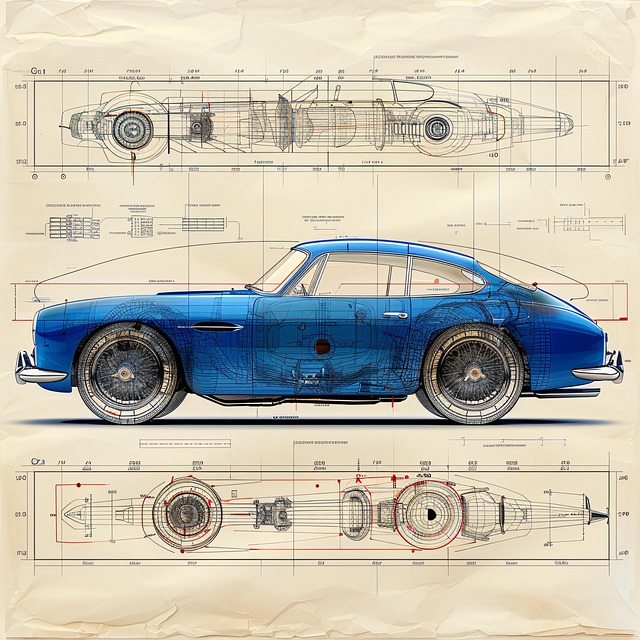

Navigating back-to-school expenses can be a daunting task for many families, especially when unexpected costs arise. This is where flexible terms on a title loan for back to school expenses come into play, offering a much-needed lifeline during this hectic time. By securing a loan using your vehicle’s equity, parents can gain access to funds quickly and efficiently.

This flexibility allows for various repayment options, including extended loan periods, which can lighten the financial burden. For instance, opting for a motorcycle title loan or considering a vehicle equity loan with adjustable terms means parents can tailor their repayments to fit their back-to-school budget. Should unforeseen circumstances require it, a loan extension might even be available, providing further relief and ensuring a smoother transition into the new academic year.

Navigating the Process: Getting a Title Loan for Educational Expenses

Navigating the Process involves understanding a Title Loan for back to school expenses as a strategic financial tool. Students and their families often find themselves in need of quick funds to cover educational costs, such as books, tuition fees, or even living expenses during the academic year. This alternative financing method offers flexibility and can be particularly useful when traditional loan options may not meet immediate needs.

The process begins with researching reputable lenders who specialize in title loans. Many of these lenders provide online applications, allowing you to apply from the comfort of your home. You’ll need to present relevant documents, such as a valid ID, proof of vehicle ownership (as collateral), and possibly employment records. Once approved, you can discuss payment plans that suit your budget, potentially offering lower interest rates compared to other short-term loan options. Even if you’re considering debt consolidation or loan payoff, a title loan’s structured repayment terms might provide relief from overwhelming debts associated with traditional student loans.

Flexible terms on title loans offer students a practical solution for covering unexpected back-to-school expenses. By understanding this quick cash option and its straightforward process, you can focus on preparing for the new academic year without financial stress. A title loan can provide the necessary funds while allowing for manageable repayment, ensuring a smoother transition to the next chapter of your education.